Market psychology and its impact on litecoin (LTC) prices

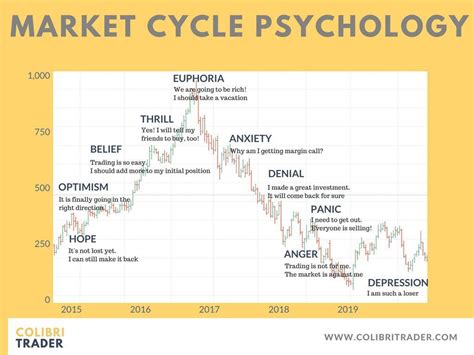

The World of Cryptocurrency Has Been a hotbed of speculation, excitement, and volatility in recent years. Among The Numerous Cryptocurrencies Av byrile, Litecoin (LTC) stands out for its unique blend of speed, decentralization, and usability. As With Any Market, Understanding the Underlying Psychology That Drives It is Crucial to Making Informed Investment Decisions. In this article, we’ll delve into the concept of market psychology and explore how it affects litecoin prices.

What is Market Psychology?

Market Psychology refers to the study of how Human Behavior Influences Market Movements and Price Trends. IT encompasses Various psychological factors that affect Investor Attitudes, Risk Tolerance, and Decision-Making Trials. Understanding thesis Psychological Drivers Helps Traders, Investors, and Market Analysts Navigate the Complexities of Cryptocurrency Markets.

Key Drivers of Litecoin Prices: Fear and Greed

Litecoin’s prices are influenced by a combination of fear and greed. Fear occurs When Investors Become Anxious About Market Volatility, Uncertainty, Or Potential Risks. In this context, LTC is of Considered a “hedge” asset, providing a Safe Haven for Those Seeking Stability in A Rapidly Changing World.

On the other hand, greed plays a significant role in Litecoin’s Price Movements. When prices surge, it can be due to speculation, hype, and excitement among market participants. Conversely, When LTC Falls, It Might Indicate That Investors Have Become Overy Optimistic or are Rushing Into Buying at An Inflated Price.

Factors Influencing Market sentiment

Several Factors Contribute to the Sentiment Surrounding Litecoin:

- Sentiment Index : The Sentiment Index Measures The Collective Attitude of Traders Towards a particular Cryptocurrency. A High Sentiment Index Can Be Indicative of Increased Optimism and Bullishness.

- News and Events

: Breakthroughs in Technology, Partnerships, OR Regulatory Changes Can Spark Excitement Among Investors, Driving LTC Prices Upwards.

- Market sentiment leaders : Investors of Follow Market Leaders (E.G., Bitcoin) to Gauge the Overall Mood of the Cryptocurrency Market. When thesis leaders are experienced strong sentiment, it may influence litecoin’s prices.

- Social Media and Online Communities

: Social Media Platforms and Online Forums Provide A Conduit for Investors to Share Their Opinions and Engage With Each Other. This can create a Snowball effect, where increased discussion and speculation lead to highher ltc prices.

Case Study: Market Psychology and Litecoin Prices

To illustrate the Impact of Market Psychology on Litecoin Prices, Let’s Examine the Price Movements of the Cryptocurrency During specific events:

May 2018: Litecoin experienced a significant Surge in its price following a major upgrade to its’s scalability solution, Lightning Network. This Event was with with an overrayingly positive sentiment index (75%), Indicating That Investors Were Optimistic About LTC’s Future Prospects.

October 2020: Following the Covid-19 Pandemic and Subsequent Economic Uncertainty, LTC Prices Dropped Sharply. The sentiment index plummeted to a low of 20%, reflecting groups about market volatility.

Conclusion

Market psychology plays a crucial role in shaping litecoin prices. Fear and Greed Are Two Primary Drivers That Influence Investor Attitudes Towards LTC. By Understanding thesis Psychological Factors, Traders and Investors Can Better Navigate the Complexities of Cryptocurrency Markets and Make Informed Decisions.

While Fits Price Movements can Serve as a guide for predicting future trends, it’s essential to approach market analysis with a nuanced perspective, Considing multiple sources and indicators.

Leave a Reply